Securing your family's future and providing peace of mind during an emotional time is possible with the right funeral insurance policy. This guide helps you navigate the process of selecting a plan that suits your unique needs, focusing on coverage options, premium structures, and additional perks like travel expense coverage and dedicated support networks. By understanding the benefits of funeral insurance policies, you can ensure your loved ones receive financial protection and access to services during grief, while also honoring your final wishes without unexpected costs.

Planning for the unexpected is crucial when it comes to burials. If you’re considering out-of-town burial expense coverage, understanding funeral insurance policies can be life-saving. This comprehensive guide explores 10 essential tips, from comprehending policy benefits and choosing the right plan to navigating claims with peace of mind. Discover how the best funeral insurance policies can provide comfort and financial security during an emotional time, ensuring your family’s burden is lightened.

- Understanding Funeral Insurance Policies: A Comprehensive Overview

- Benefits of Out-of-Town Burial Expense Coverage

- Choosing the Best Funeral Insurance Plan for Your Needs

- Key Factors to Consider When Comparing Policies

- Uncovering Hidden Costs and What They Mean for Your Family

- Navigating Claims Process: Ensuring Peace of Mind After a Loss

Understanding Funeral Insurance Policies: A Comprehensive Overview

Benefits of Out-of-Town Burial Expense Coverage

Out-of-town burial expense coverage offers numerous benefits for individuals and their families during an emotionally challenging time. When navigating funeral arrangements, unexpected costs can arise, especially if travel and accommodation are involved. The best funeral insurance policies provide peace of mind by covering these expenses, allowing families to focus on grieving rather than financial worries.

Funeral plan benefits extend beyond financial assistance. They often include access to a dedicated support network, which can be invaluable when dealing with the loss of a loved one. These policies may also offer pre-and post-funeral services, ensuring a comprehensive approach to planning and managing funeral arrangements, ultimately providing comfort and security for families during their time of need.

Choosing the Best Funeral Insurance Plan for Your Needs

Choosing the best funeral insurance plan is a personal decision that depends on your unique circumstances and preferences. When considering funeral insurance policies, assess your financial situation and the potential future costs associated with end-of-life arrangements. Different plans offer varying levels of coverage, including options for burial expenses, cremation fees, and even memorial services. Opting for a comprehensive plan that aligns with your needs can ensure peace of mind knowing that your loved ones won’t face unexpected financial burdens during an already difficult time.

Explore various funeral insurance policies to find the one that provides the best balance between cost and benefits. Some policies offer guaranteed acceptance, making them suitable for individuals with pre-existing medical conditions or age-related concerns. Others may include add-on features like life insurance coverage, which can be beneficial for those seeking long-term financial security. By thoroughly understanding the terms and conditions of each plan, you’ll be better equipped to make an informed decision that prioritizes both your present and future needs.

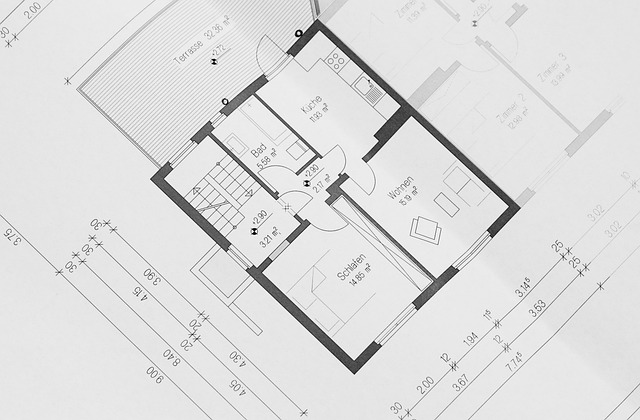

Key Factors to Consider When Comparing Policies

When comparing funeral insurance policies, several key factors come into play to ensure you’re making an informed decision. Firstly, consider the scope of coverage offered by each policy. What specific expenses are included? Do they cover burial costs, cremation fees, and even memorial services? Understanding these benefits is crucial in determining if a policy aligns with your needs.

Additionally, assess the financial stability of insurance providers. Researching their history and claims-paying ability ensures that you’re choosing a reliable company. Look into customer reviews too; testimonials from those who have availed of these policies can provide valuable insights into the quality of service and support offered by different funeral insurance companies.

Uncovering Hidden Costs and What They Mean for Your Family

When planning for a loved one’s funeral, many families are caught off guard by unexpected costs that can significantly impact their financial well-being. These hidden expenses often include various services and products that contribute to a meaningful send-off but can add up quickly. Uncovering these costs is essential to ensuring your family isn’t burdened with unexpected bills during an already challenging time.

A comprehensive funeral plan, such as the best funeral insurance policies, can help mitigate these hidden costs. Funeral insurance policies offer various benefits, including coverage for traditional burial services, cremation expenses, death certificates, and even cemetery plots. Understanding what is included in these plans can provide peace of mind and financial security for families. By choosing a suitable funeral insurance policy, you can ensure that your loved one’s final wishes are respected while also protecting your family from unexpected financial obligations.

Navigating Claims Process: Ensuring Peace of Mind After a Loss

Navigating the claims process after a loss can be emotionally challenging, and understanding your funeral insurance policy is crucial to ensuring peace of mind during this difficult time. The best funeral insurance policies offer clear guidelines and straightforward procedures for making claims, with dedicated support teams ready to assist. These plans typically cover various funeral plan benefits, such as burial expenses, cremations costs, and even memorial service arrangements.

When choosing a policy, look for one that provides comprehensive coverage, fast processing times, and responsive customer service. A well-designed claims process should be hassle-free, allowing you to focus on honoring your loved one’s memory rather than navigating complex paperwork. Remember, in the midst of grief, having a reliable funeral insurance policy can bring significant relief and support during what is already an emotionally taxing period.

When considering out-of-town burial expense coverage, understanding funeral insurance policies becomes crucial. By delving into the benefits of such coverage and choosing a plan that aligns with your needs, you can ensure peace of mind for your family during an emotional time. Remember, navigating claims process efficiently is key to making this challenging period as stress-free as possible, allowing you to focus on honoring your loved one’s life. With the right funeral insurance policies in place, the financial burden of out-of-town burials can be significantly reduced, providing a lasting testament to care and compassion.